If you have been reading the headlines recently, you may be expecting that the market is about to fall from the sky. Your concern is understandable. Gas prices have skyrocketed, there’s talk of inflation, and it feels like there’s a daily interest hike. However, in terms of real estate doom and gloom, some of these stats may surprise you.

Quick Take:

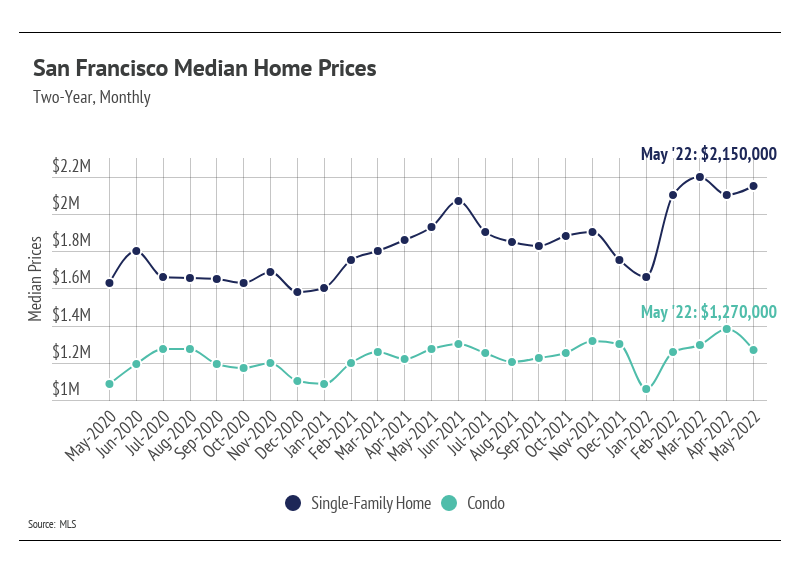

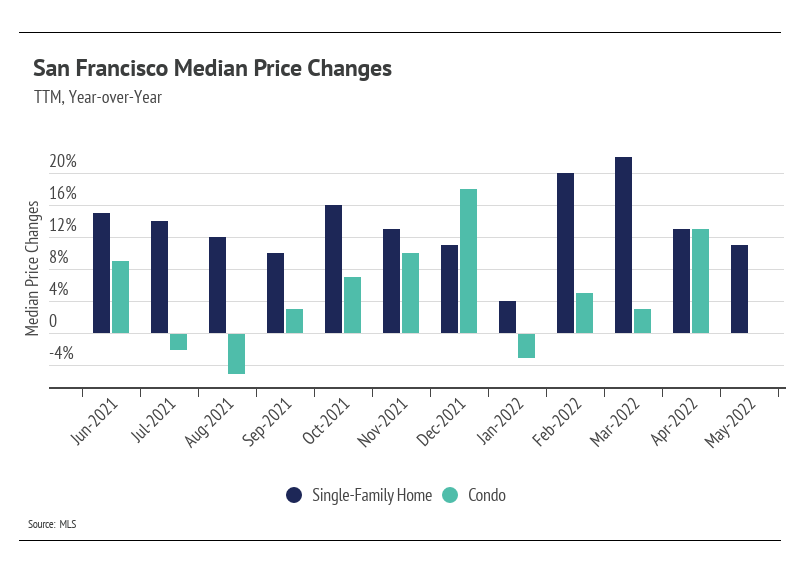

- Single-family home prices in San Francisco landed just below the March high, while condo prices fell from the April peak.

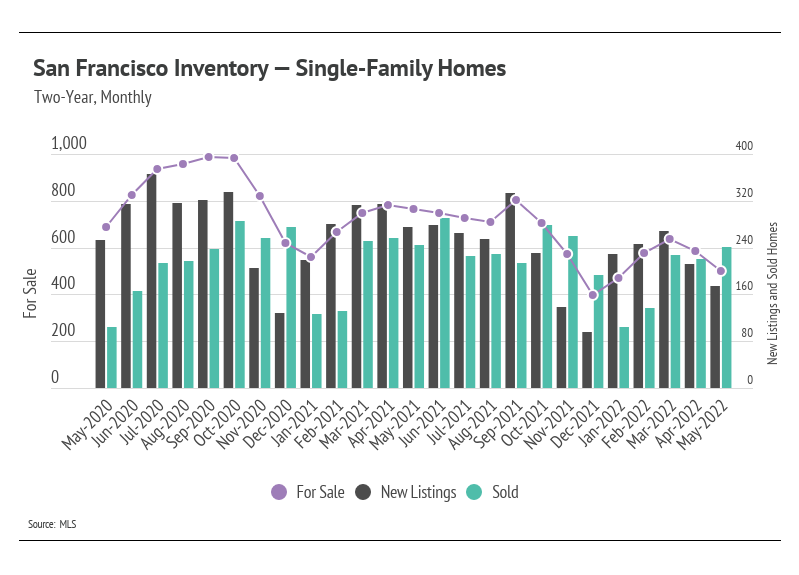

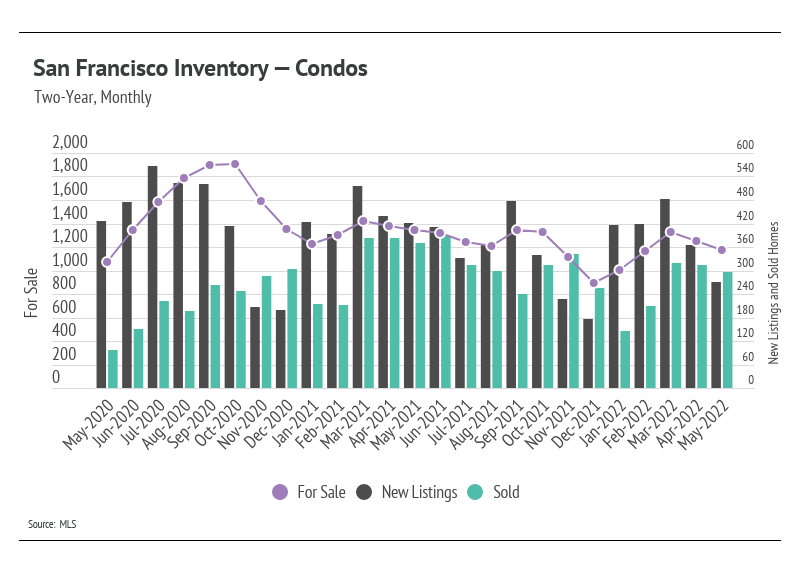

- The second quarter of 2022 will indicate whether the market is moving toward or away from normalization. May data show that the number of homes for sale declined, which indicates that inventory will likely remain historically low this year.

- Demand for homes in San Francisco has yet to be diminished by rising mortgage rates and historically low inventory.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Home prices continue to rise as new listings meet high demand

The median single-family home price rose in May, landing just below the all-time high reached in March, while the median condo price declined from the April peak. Rising rates haven’t brought down home demand so far, and in a rising rate environment, buyers are better off locking in an interest rate sooner rather than later. Since the start of 2022, the average 30-year mortgage rate has increased 2%, which equates to a 27% increase in monthly mortgage payments. Yet prices keep moving higher.

One reason that home prices continue to rise is that buying a home is not only a financial process but also an emotional one. Over the past two years, our homes have become such a large part of our lives, with many of us moving to permanently remote or hybrid work. As more homes come to the market, as is typical in the first half of the year, buyers are more likely to find the home that’s right for them in what’s been an incredibly competitive market. Even with increases in mortgage rates (which, again, are still historically low), it’s reasonable to pay more for the well-being that comes with buying the right home. For most of us, our home is our largest asset and store of wealth, so treating it as such makes sense.

Declining inventory, way ahead of schedule

San Francisco’s housing inventory declined in May for the second month in a row, which serves as an early indicator that home supply will remain significantly depressed this year. The high demand and lack of new listings over the past year brought single-family home and condo supplies to record lows as we entered 2022. Although the first quarter of 2022 had one of the lowest inventories on record, we were pleased to see that inventory increased, a trend that usually holds until mid-summer. But with inventory reversing in April and May, the likelihood of a strong inventory increase is slim.

Even though inventory is low, sales remain relatively high, outpacing new listings for both single-family homes and condos. Sellers can expect multiple offers, and buyers should come with competitive offers.

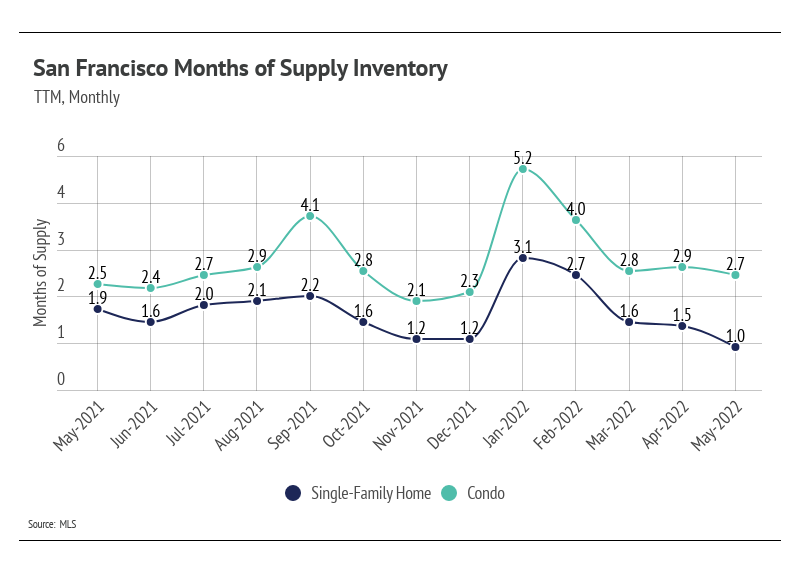

Months of Supply Inventory further indicates high demand and low supply

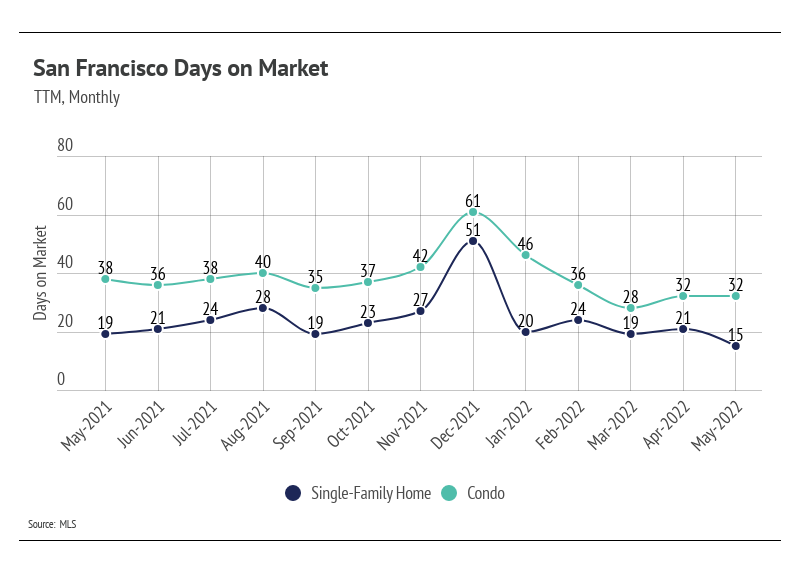

Homes are selling faster than ever. Buyers must put in competitive offers, which, on average, are 14% above the list price for single-family homes and 6% above list for condos.

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The average MSI is three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). Currently, single-family home and condo MSIs are low, indicating a strong sellers’ market.

Local Lowdown Data