Key News and Trends Impacting Your Local Market

May 29, 2020

May 29, 2020

Welcome to our May newsletter. We know homeowners have questions about home values and the equity they have built up these past few years. Potential buyers want to understand changing market conditions and how to negotiate the best offer for themselves. With that in mind, an overview of the numbers indicate the San Francisco housing market is looking quite strong. This month’s topics include:

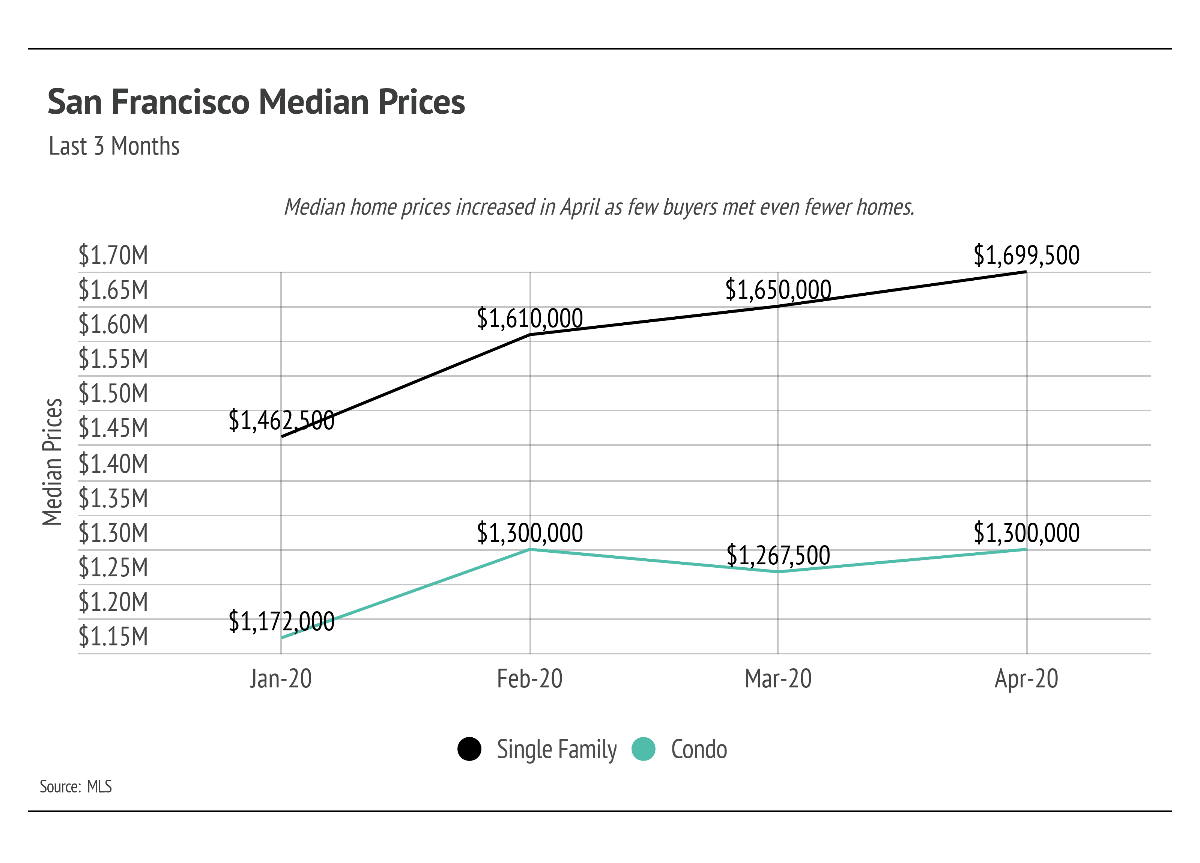

April home and condo prices rose in San Francisco on both a monthly and yearly basis. Even more surprisingly, home and condo prices fell only slightly statewide. In April, California median home prices declined 1% according to the California Association of Realtors (CAR).

As we reported in our March and April newsletters, the fundamentals of the housing economy remain strong. In April, despite the fact that forecasters downgraded the U.S. economic outlook due to the effects of the pandemic, mortgage-finance giant Fannie Mae said that it expects the 2020 national median existing-home prices to rise from $272,000 to $275,000. Demand and supply have not moved in lock step and demand still outpaces supply. The National Association of Realtors (NAR) reported that even though buyer demand softened and nationwide sales fell 8.5% from the prior month, the supply of homes on the market decreased even faster. Even before the pandemic, the housing market was undersupplied for years. Lawrence Yun, NAR’s chief economist, emphasized the persistent supply issue when he said in April, “You would have to see continuing job losses for a prolonged period leading to foreclosures, and even then we may not have oversupply.”

As we reported in our March and April newsletters, the fundamentals of the housing economy remain strong. In April, despite the fact that forecasters downgraded the U.S. economic outlook due to the effects of the pandemic, mortgage-finance giant Fannie Mae said that it expects the 2020 national median existing-home prices to rise from $272,000 to $275,000. Demand and supply have not moved in lock step and demand still outpaces supply. The National Association of Realtors (NAR) reported that even though buyer demand softened and nationwide sales fell 8.5% from the prior month, the supply of homes on the market decreased even faster. Even before the pandemic, the housing market was undersupplied for years. Lawrence Yun, NAR’s chief economist, emphasized the persistent supply issue when he said in April, “You would have to see continuing job losses for a prolonged period leading to foreclosures, and even then we may not have oversupply.”

The Wall Street Journal reported that some sellers “are hanging tough because they believe their homes aren’t moving because buyers haven’t viewed them in person or are reluctant to make offers right now, not because the asking price is too high.” In other words, sellers may be waiting for stay-at-home orders to ease before deciding whether to lower prices. Additionally, The Wall Street Journal reported that both real estate agents and homebuilders confirmed that active buyers are more serious than ever before and mortgage applications are being approved and funded at a much higher rate than normal. The low interest rate environment and a need for a home during a pandemic has created a sense of urgency for homebuyers.

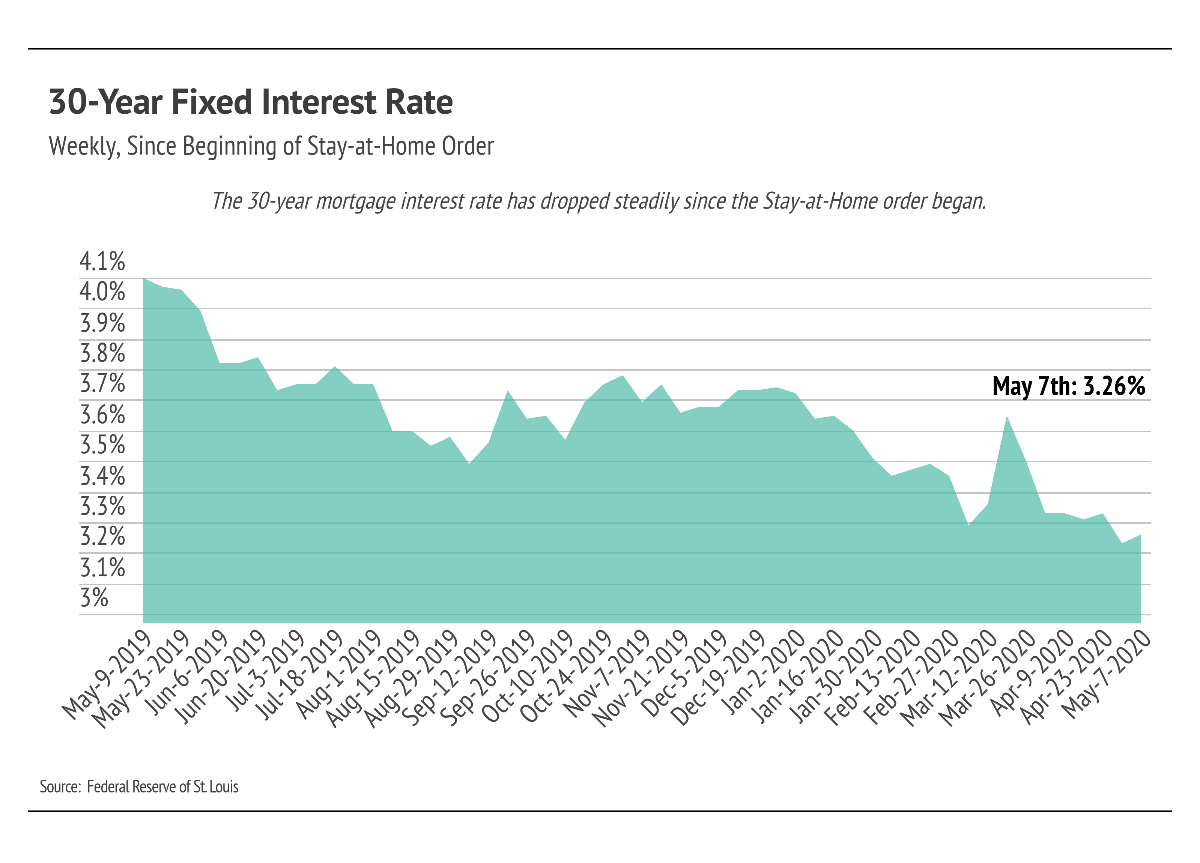

While home values remain intact, many homeowners are using this time to refinance their homes. In the first week of March, the Mortgage Bankers Association reported that refinance applications rose by 79% for the week and were 479% higher than a year ago. This is the highest level of refinancing since April 2009. On May 13th, the Mortgage Bankers Association reported that refinances are still up 201% compared to the previous year. The falling mortgage rates in March generated a refinance boom, and since March, rates have fallen even further.

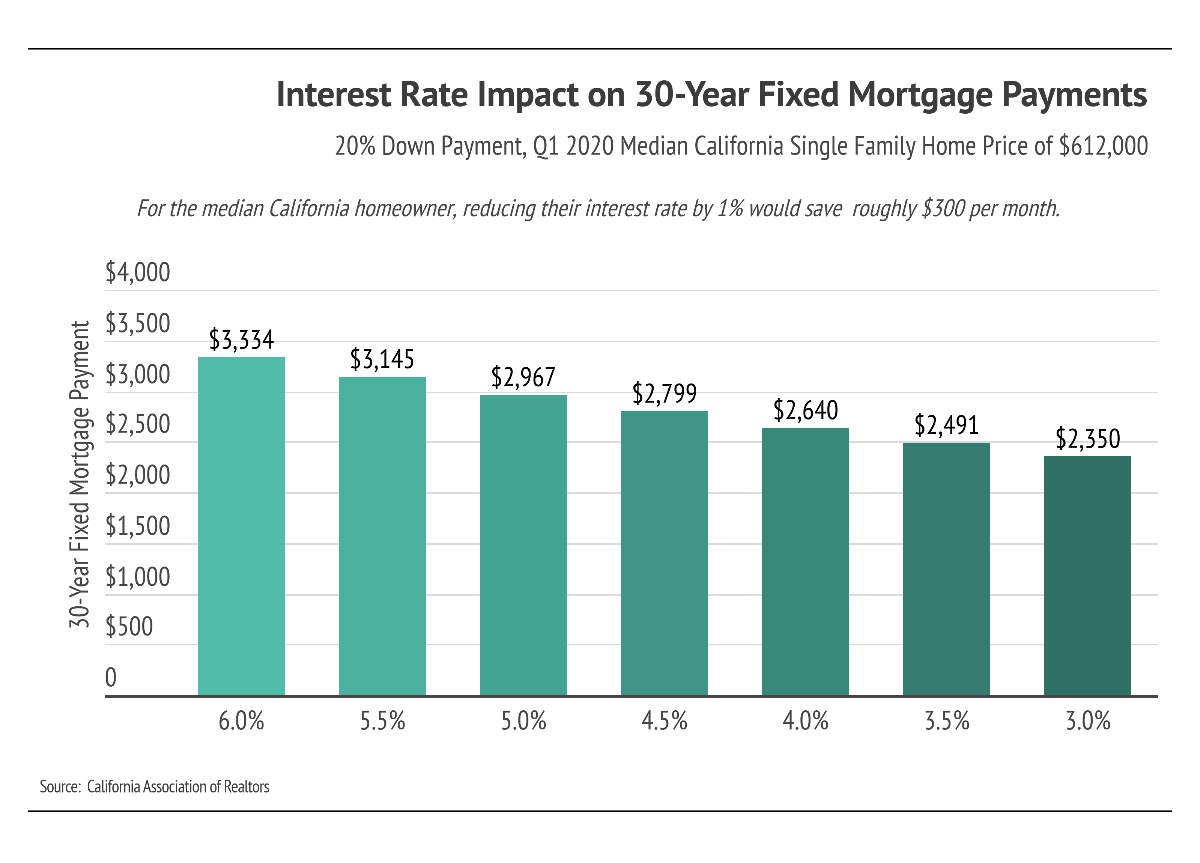

As a general rule of thumb, homeowners benefit from refinancing if they can lower their rates by at least 1%. Refinancing also provides an opportunity to dispense with private mortgage insurance (PMI), as long as the value of the home has risen and the owner has enough equity in the home.

For owners of Q1 2020 median-priced California homes ($612,000), a 1% reduction would reduce monthly payments by $300. The savings for a median-priced home in San Francisco ($1.7 million) is around $800 per month. Refinancing, however, comes with costs, which include title insurance, attorney’s fees, the price of an appraisal, taxes, and transfer fees, among others. Expect refinancing to run anywhere between $1,500 and $5,000. While most costs are fixed, appraisals are variable and cost more for larger homes.

The second biggest determinant of whether or not to refinance, therefore, is whether or not the homeowner plans to stay in the home long enough to recoup the costs of refinancing. For instance, if refinancing costs $4,000 and the homeowner stands to save $800 each month on their mortgage payment, then their costs will be recouped after five months of living in the home. As a result, the homeowner would benefit from refinancing if they plan to stay in the home for longer than five months.

Due to the large cost savings and short breakeven period for refinancing, the number of refinance eligible borrowers—borrowers paying interest 0.75% or higher than current rates with credit scores above 720 and enough equity to get a new loan—rose to 11.3 million, the second-highest on record, according to Black Knight.

For homeowners looking to sell rather than refinance, technology continues to change how the real estate market operates.

Stay-at-home orders make video calling a daily activity, which has quickly increased the overall comfort level with technologies like Zoom, Skype, and FaceTime across demographics. 3D virtual tours have become commonplace over the last several years, but they are even more important now. Video call showings are becoming more normalized with each passing day. Exact data on the increase in agent-led virtual tours is difficult to gather with an MLS, but in March, CNBC provided some color using data from Zillow and Redfin. Zillow showed a 191% increase in the creation of 3D virtual home tours in the first week of March compared to February, and Redfin’s requests for agent-led video tours increased 94x from the first week of March to the last.

Because of the rapid adoption and comfort with video technology, we expect the market to normalize relatively quickly, bringing sales volumes and inventory back to more typical seasonal trends and helping restore a more balanced market.

Stay up to date on the latest real estate trends.

December 19, 2025

Escape the San Francisco Winter Chill

December 5, 2025

How Savvy Buyers Can Find Opportunity

December 4, 2025

In November 2025, 14 single-family homes sold in Bernal Heights.

December 1, 2025

In November, there were 19 single family and condo home sales in Pacifica. Closed listings range in price from $520K to $1.65M.

You’ve got questions and we can’t wait to answer them.