Supplemental Taxes Explained (San Francisco County)

September 14, 2021

September 14, 2021

A new homeowner has a lot to learn. The home buying process itself can be a steep learning curve. That’s one of the main reasons it is essential to work with an agent that spends the time to guide you through the entire process and explain all the terminology. There should never be any surprises. And yet, we often hear new homeowners completely blindsided by a supplemental tax bill. Let’s define what supplemental taxes are, how they are calculated, and when they are expected.

Governor Jerry Brown introduced the Supplemental Real Property Tax Law in 1983 to fill the gap between when a home’s value increases from improvements or a sale and the next tax year. Jerry estimated this new law would generate $300 million additional revenue each year. The proceeds of this additional revenue go to help fund California schools.

Under Prop 13, there is a 2% limit to property tax growth per year. When ownership changes (ie. you sell or buy a home), Prop 13 requires the assessor’s office to realign a property’s assessed value to the updated market value.

Supplemental taxes are not just for the transfer of titles. These taxes also apply for major improvements to your home that increase the value of the home.

Learn more about SF property taxes here.

In order to calculate the supplemental taxes owed apply the current tax rate to the new assessed value and then prorating it for the amount of time the home is owned in that tax year. See below for an example from San Francisco assessor, Carmen Shu.

As a homeowner, you are responsible for paying taxes on the assessed value of your home. Any new construction or major improvements to the home will result in an increase in your home value and your assessed tax rate.

When you sell your home, it is most common that at the time of escrow, you will be reimbursed for the tax your paid for the fiscal months you no longer own the home.

Know that when buying a home you are responsible for reimbursing the previous home owner for the taxes paid on the home through the rest of the fiscal year. Chances are, the home you are buying has gone up in value since the previous owner bought it. This means not only are you responsible to reimburse what the previous owner paid, but you must also cover the increased value that you paid on the home.

No. The supplemental tax bill is sent in addition to the annual tax bill and both must be paid. However, a supplemental tax bill only happens after new construction or a reassessment due to a change in ownership.

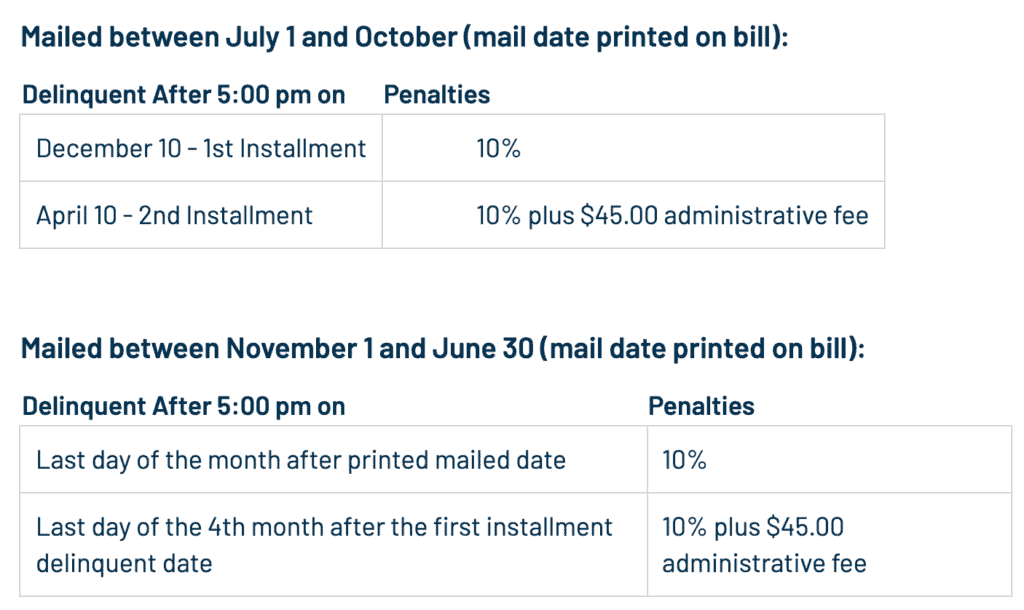

You are able to pay in two equal installments on specified dates depending on the month.

Yes, your supplemental property tax payments are deductible.

Stay up to date on the latest real estate trends.

February 27, 2026

Securely shredding real estate paperwork protects San Francisco homeowners from identity theft and deed fraud

February 19, 2026

SF Bay Area Housing Market Update February 2026

February 19, 2026

7 Powerful Reasons Sellers Trust Their Team

February 13, 2026

Understanding how air rights, parking, easements, and exclusive-use areas can impact value, expansion potential, and resale in San Francisco.

You’ve got questions and we can’t wait to answer them.