Quick Take

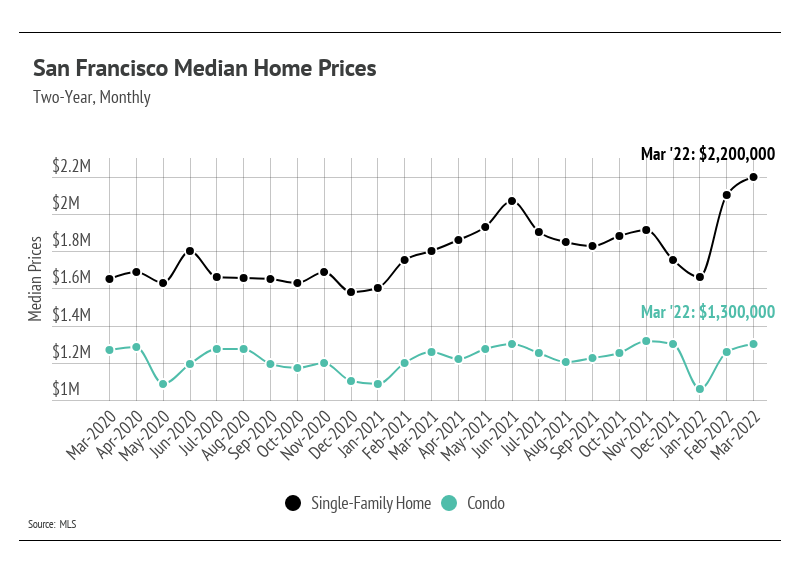

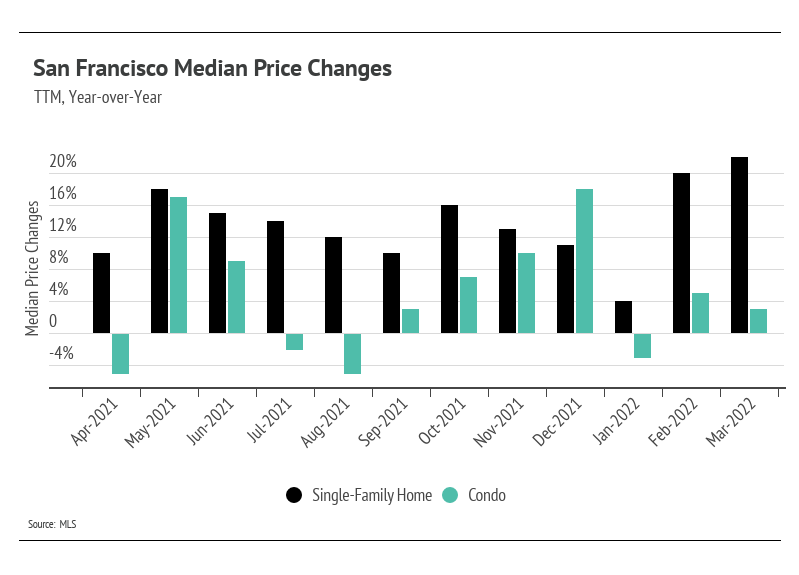

- Home prices continued to climb in March, reaching an all-time high for single-family homes in terms of both median price and price per square foot. Condo prices didn’t return to peak, but they are historically high.

- Single-Family Homes: +22% year-over-year

- Condos: +3% year-over-year

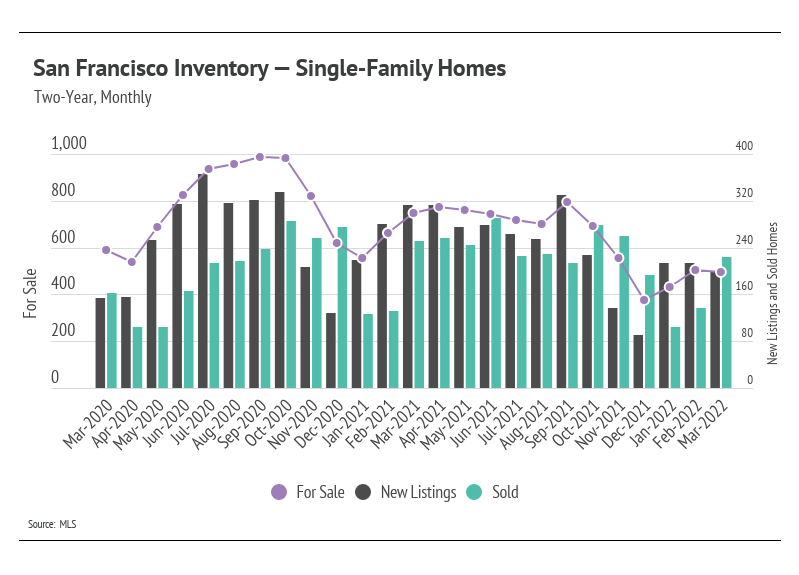

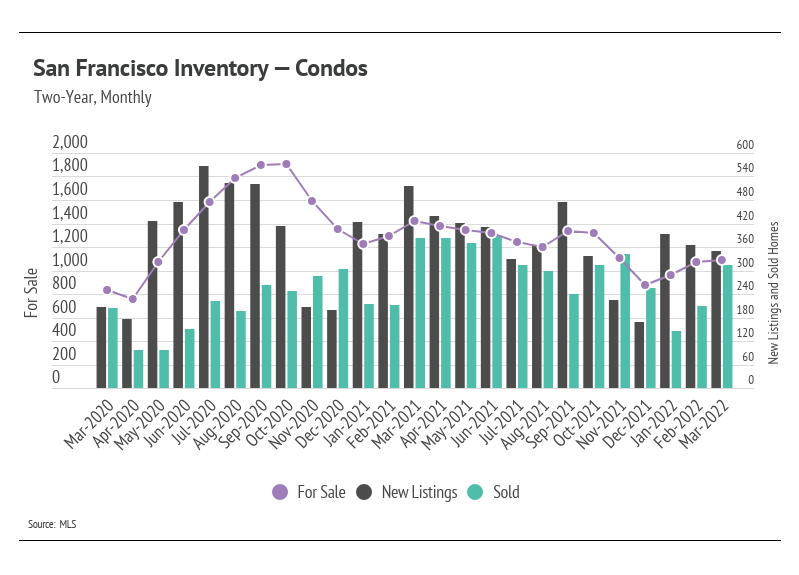

- Inventory is rising, a historical seasonal norm. However, we are entering into the spring season with the lowest inventory on record in San Francisco.

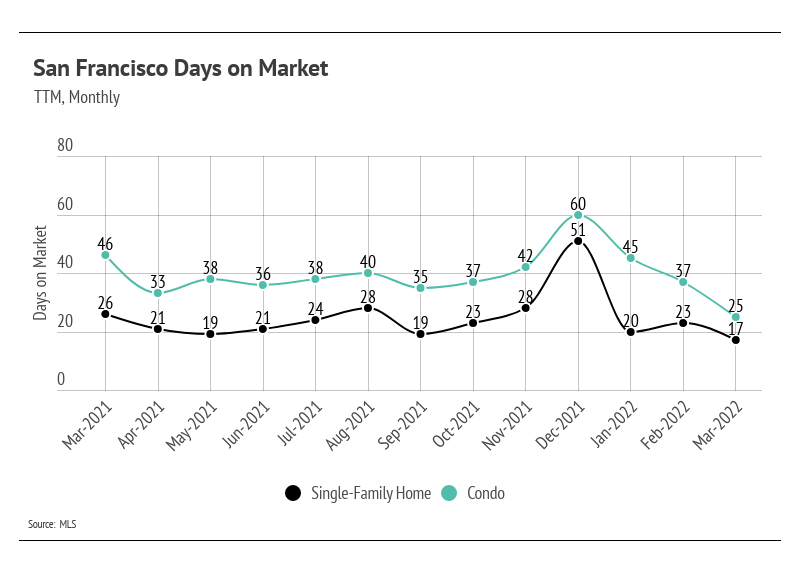

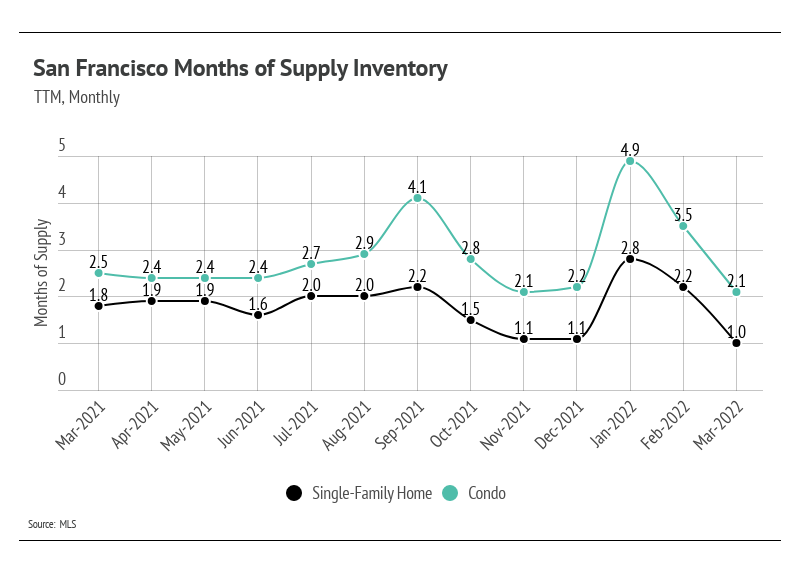

- Months of Supply Inventory further indicates a sellers’ market. Homes are selling quickly as buyers compete over the limited inventory.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Home prices close the first quarter at record highs

Single-family home and condo prices rose significantly over the past two months, reaching an all-time high for single-family homes. Because sales often have a one-month lag, with homes going under contract around a month before the sale is complete, we cannot yet determine how significantly increasing rates have hit the market. Mortgage rate hikes really only lower demand in the long term, but in the short term, demand increases as buyers try to lock in a lower rate. The San Francisco housing market has a major advantage in that high demand is constant. Despite the huge increases in home prices over the past 12 months, San Francisco’s lack of housing supply will keep prices rising in the coming months.

The Fed is expected to raise interest rates by 0.25% at least six times this year, going from 0% to 1.90%. We are now entering a period where factors that affect prices are more mixed, unlike the past two years when all the factors caused prices to increase. Rising interest rates, which will hopefully curb the still-rising, 40-year-high inflation rate, will make homes less affordable and dampen demand over the course of the year. But inventory is so low that even with less demand, the market will likely remain undersupplied. It might seem counterintuitive that home prices can still appreciate after increasing so much over the past two years, but with inventory at record lows, home prices in 2022 will still increase — though at a slower rate than in 2021. With high sales relative to the available inventory, we anticipate a competitive market in the year ahead.

Low, but rising, inventory

San Francisco, like the rest of the country, has a historically low housing inventory. The sustained high demand and lack of new listings over the past year brought single-family home and condo supplies to record lows across markets. Although the first quarter of 2022 had the lowest inventory on record, we are pleased to see that inventory is increasing. If this upward trend continues into the second quarter, that will be a large indicator that the housing market is normalizing.

Sales have still been incredibly high, especially when accounting for available supply, again highlighting demand in the area. Sellers can expect multiple offers, and buyers should come with competitive offers. The incredibly high demand we’ve seen over the past year might wane as interest rates increase; however, the supply is so low that the market can handle a drop in demand without negatively affecting prices. The 30-year average fixed-rate mortgage hasn’t climbed above 5% yet, but it almost certainly will. If mortgage rates reach 5%, demand will likely decline more substantially. In the next few months, demand will remain high relative to available supply.

Months of Supply Inventory further indicates high demand and low supply

Homes are selling extremely quickly in these luxury markets. Buyers must put in competitive offers, which, on average, are 16% above the list price for single-family homes and 6% above list for condos.

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes for sale on the market to sell at the current rate of sales. The average MSI is three months in California, which indicates a balanced market. An MSI lower than that indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). Currently, single-family home and condo MSIs are exceptionally low, indicating a strong sellers’ market.

Local Lowdown Data